Genius Foods Secures £7.5m Asset Based Loan from Shawbrook

Over the past few years, there has been a rise in demand for gluten-free baked goods as more people choose them for various reasons, such as gluten intolerance or to maintain a healthier lifestyle. Genius Foods is a company that produces gluten-free baked goods, such as bread, rolls, muffins, plus lots more, and are known as one of the top companies in this sector.

Now, Genius Foods has obtained a £7.5 million Asset Based Loan (ABL) from Shawbrook, adding to its achievements. This article delves into a more detailed analysis of the loan, explores the underlying reasons for it, and discusses how it may affect Genius Foods.

About the newly secured loan

The loan package includes three different types of loans: a £5 million invoice-financing line, a £1.5 million property loan, and a £1 million cash flow loan, with all these loans being spread out over a three-year period.

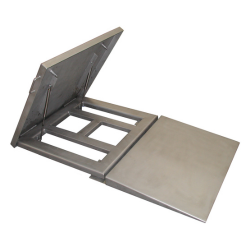

The funds obtained by Genius Foods will be used for two purposes – refinancing an existing invoice finance line and enhancing the efficiency and production lines of their bakery situated in Bathgate, Scotland. This move will help boost the production capacity of Genius Foods, which was recently acquired by the Germany-based confectionery business Katjes Group.

The relationship with Shawbrook

Genius Foods secured an asset-based loan by partnering perfectly with Shawbrook, a specialised lender. Shawbrook’s team, who had met with Genius for the first time in 2019, were selected to assist with the refinance after the acquisition by Katjes was completed in July 2022.

The strong personal relationship that developed during the acquisition negotiations was the reason for this, making the partnership more successful due to them taking the initiative and time to understand the operation thoroughly, and more importantly, their ability to provide an all-encompassing ABL package that met all of Genius’s requirements.

Another major reason why Shawbrook was chosen was because of their unwavering dedication to the deal, despite the challenges of increasing costs and uncertainty in supply. Shawbrook has been very supportive over the years and provided Genius with a flexible package, which was unparalleled to any one else.

What will this loan do for Genius Foods?

The loan will greatly support Genius Foods in aiding in achieving its growth goals. It will enable the company to innovate, expand into new markets, and keep up with the increasing demand for gluten-free products; as the rise in demand for gluten-free products is expected to continue, making it critical for Genius Foods to act accordingly and keep up.

In addition, the loan underscores how asset-based lending can be valuable for small to medium sized enterprises (SMEs) that struggle to obtain traditional debt financing. Companies can use their assets such as inventory, accounts receivable, or machinery as collateral to access funding through asset-based lending.

To sum up, Genius Foods has achieved a noteworthy accomplishment with the secured asset-based loan, which reflects the company’s excellent standing. The company will use the funds to improve its production process and continue growing. Moreover, it emphasises how asset-based lending can aid small and medium enterprises in acquiring funds to invest in their ventures.

It can also be expected that there will be more collaborations of this nature in the future, as more businesses adopt asset-based lending to achieve their growth goals. And finally, it’s great to see that Genius Foods is expanding its reach and still providing tasty gluten-free products for customers to enjoy.

News Credits: Genius Foods secures £7.5m loan to support growth

Things you may also like:

- Weetabix Marvels at New 100% Fully Recyclable Packaging

- Wyke Farm’s £10 million Investment Into a Butter Dairy

- Researchers Find a New Way to Ferment Cheese in Just Days